Imagine a world where your funding options are not limited by rigid bank loans or elusive venture capital. That world is here in 2026, as economic shifts and technological advances open doors to new financial avenues.

The era of relying solely on traditional financing methods is fading, replaced by a dynamic ecosystem of unconventional sources. High interest rates and constrained bank lending have made this transition not just desirable, but essential for growth and innovation.

From startups to personal aspirations, these alternatives offer flexible and accessible pathways to turn ideas into reality. This article explores how you can tap into these opportunities, backed by the latest trends and data.

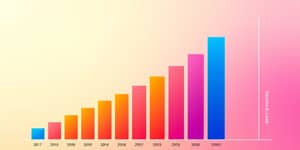

2026 marks a pivotal year for funding, driven by recovery in lending volumes and regulatory changes. Economic uncertainty has sparked a demand for more adaptable solutions.

Artificial intelligence is fueling this shift, creating new demands for data centers and green projects. This context makes unconventional sources more relevant than ever.

Understanding the variety of options available is the first step. Each source comes with its own benefits and challenges, tailored to different goals.

Below is a comprehensive table comparing the primary unconventional funding sources, based on 2026 outlooks.

The appeal of these sources lies in their adaptability and inclusivity. They cater to diverse needs, from small business growth to personal dreams.

Key benefits include:

These advantages make alternative financing methods a powerful tool in today's economy. They empower individuals and businesses to navigate financial challenges creatively.

The current year is defined by several key trends that influence how funding is accessed and utilized. Understanding these can help you stay ahead.

Major trends include:

These trends highlight the importance of staying informed and adaptable. They show how funding is evolving to meet new demands.

Certain industries are seeing a surge in unconventional funding due to high growth potential and societal needs. Targeting these sectors can increase your chances of success.

Key sectors benefiting from unconventional funding:

Focusing on these areas can leverage thematic investment trends for better funding outcomes. They represent where innovation and capital are converging.

While unconventional funding offers many benefits, it's not without risks. Being aware of these challenges is crucial for making informed decisions.

Common risks include:

To manage these, it's essential to conduct thorough due diligence and align funding with your risk tolerance. Expert advice can also help navigate complexities.

Matching your funding needs to the appropriate source is key to success. Different goals require different approaches.

Consider these factors when choosing:

By evaluating these aspects, you can maximize your funding potential and achieve sustainable growth. It's about finding the fit that empowers your journey.

The shift to unconventional funding sources represents a transformative opportunity in 2026. It empowers diverse actors to pursue their goals with creativity and resilience.

By exploring options beyond banks, you can access capital that is more aligned with your values and needs. The future of funding is here, and it's vibrant, inclusive, and full of promise.

Take action today by researching these avenues and leveraging the trends shaping our economy. Your dreams are within reach, supported by a world of innovative financing.

References