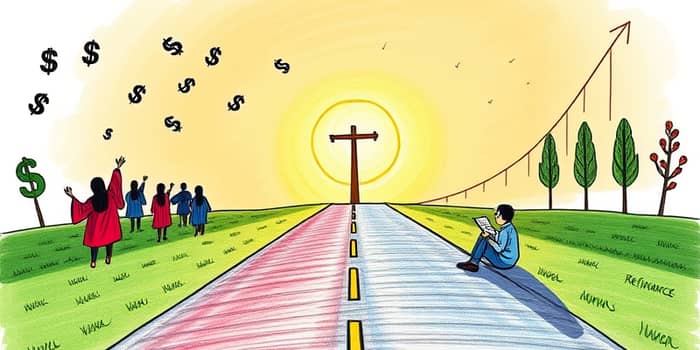

For many graduates, student loan debt can feel like a constant shadow, weighing down dreams and delaying milestones. Yet strategic options exist that can transform an overwhelming burden into manageable steps toward freedom.

By understanding federal forgiveness programs and private refinancing, you can choose the solution that best fits your unique circumstances and goals.

Loan forgiveness programs are designed to eliminate some or all debt for borrowers who meet specific criteria. These options primarily apply to federal student loans and can offer a path to financial freedom.

Borrowers typically must work in public service or choose an income-driven repayment plan to qualify. Currently, the federal government offers a dozen forgiveness, discharge, or repayment assistance programs tailored to diverse careers and life circumstances.

Public Service Loan Forgiveness (PSLF) requires 120 qualifying monthly payments—about ten years—while employed full-time by a qualifying organization. After meeting the requirements, the remaining loan balance is forgiven without tax liability.

Income-Driven Repayment plans, such as SAVE, PAYE, IBR, and ICR, set monthly payments based on income and family size. Borrowers may pay nothing in months when income falls below a certain threshold. After two decades or more of consistent payments, the balance is forgiven.

Teacher Loan Forgiveness can erase up to $17,500 for qualified elementary and secondary teachers serving five consecutive years in high-need schools. This program cannot overlap with PSLF for the same service period.

Before applying, confirm your loan type by checking your National Student Loan Data System. Only federal Direct Loans typically qualify for forgiveness programs. If you hold older loans, you may need to consolidate older federal loans into a Direct Consolidation Loan to participate.

Refinancing replaces one or more existing student loans with a new private loan, often at a lower interest rate. Unlike federal consolidation, refinancing can lower the interest rate and potentially the monthly payment amount.

While refinancing removes federal loan protections, it can be a powerful tool to achieve a stable financial future if you have strong credit and a solid income.

Private lenders set eligibility standards that typically include credit scores in the mid-600s or higher, proof of steady income, and a favorable debt-to-income ratio. Graduates with excellent credit (above 700) can secure the most competitive terms.

Consider the trade-off: refinancing federal loans means losing access to forbearance, IDR plans, and forgiveness opportunities. Weigh the immediate savings against potential long-term benefits.

Deciding between forgiveness and refinancing requires careful reflection on career goals and financial stability. If you plan a career in public service or education, forgiveness may offer unmatched relief. If you prefer more predictable payments and can secure a low rate, refinancing could be your answer.

Make a side-by-side analysis of estimated monthly payments, total interest paid, and future flexibility. Always factor in unexpected life events, such as unemployment or reduced income, when choosing between these options.

Start by requesting a detailed loan history from your servicer. This will help you map out which loans are federal and which are private. Next, calculate potential monthly savings and compare them against your current payments.

Speak with a financial counselor or use free resources at StudentAid.gov to explore eligibility tools. If considering refinancing, gather multiple quotes from reputable lenders and analyze terms thoroughly.

Under current law, forgiven balances through PSLF and IDR plans are tax-free until December 31, 2025. After that date, forgiven amounts may be considered taxable income unless the law is extended.

Stay informed about policy changes, such as temporary adjustments to payment counts and potential expansions of forgiveness programs. Bookmark official announcements and sign up for updates from the Department of Education.

Student loan debt can be overwhelming, but it does not have to define your future. By understanding the full range of forgiveness options and carefully weighing the pros and cons of refinancing, you can take control of your repayment journey and move toward your financial goals with confidence.

Remember, seeking professional personalized advice and guidance can clarify complex decisions and ensure you choose the path best suited to your life and career. Your efforts today can secure a brighter tomorrow and pave the way for long-term financial well-being and security.

References