Facing a loan denial can feel like a door slamming shut on your dreams, whether it's for a home, car, or business venture.

In today's uncertain economy, rising rejection rates are transforming this experience from a rare setback into a common reality for many.

However, this moment of rejection doesn't have to define your financial future; instead, it can become a catalyst for empowerment and strategic action.

By understanding the landscape and knowing how to respond, you can navigate these challenges with confidence and resilience.

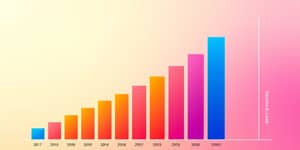

The data paints a stark picture of increasing financial hurdles for consumers and businesses alike.

Mortgage application rejection rates have surged, highlighting tighter credit conditions and economic pressures that affect millions.

This trend is not isolated but part of a broader shift in lending practices that prioritizes risk aversion.

These statistics underscore a reality where economic pressures like recession fears are reshaping access to credit, making it essential to adapt and persevere.

Lenders are required to provide an adverse action notice detailing the specific reasons for a denial, which often roots back to key financial factors.

Understanding these reasons is the first step toward addressing them and building a stronger case for appeal.

For specific loan types, such as mortgages, rejections are often tied to subdued credit access expectations, while business loans may suffer from misinterpreted financials.

By identifying these pain points, you can proactively work to correct them and improve your chances in the future.

Appealing a loan denial, often through a reconsideration or second-look review, offers a powerful opportunity to reverse the decision by addressing errors or providing new evidence.

This process can be faster and more effective than reapplying, saving you time and protecting your credit score.

There are different types of appeals, including administrative checks for procedural errors and underwriting reconsideration for re-evaluation with new data.

For SBA loans, a multi-layer appeal process exists, emphasizing the importance of persistence and thorough documentation.

Deciding whether to appeal or pursue other options requires careful consideration of your unique situation and the lender's flexibility.

An appeal is most viable when there are incomplete or misinterpreted documents that can be easily corrected or when recent financial improvements have occurred.

It's crucial to have a parallel plan in place, as building better financial practices, such as managing credit utilization ratios, can enhance future success.

This strategic approach ensures that you don't put all your eggs in one basket and remain adaptable to changing circumstances.

Beyond the immediate steps, a loan denial can serve as a wake-up call to strengthen your overall financial health and preparedness.

By adopting proactive habits, you can reduce the likelihood of future rejections and increase your confidence in navigating the credit landscape.

This long-term perspective turns a momentary setback into a stepping stone toward greater financial literacy and stability.

To address common concerns and provide quick insights, here is a table summarizing key FAQs about loan denials and appeals.

This resource empowers you with actionable knowledge, helping demystify the process and reduce anxiety around financial setbacks.

Remember, every rejection is an opportunity to learn, grow, and emerge stronger in your financial journey.

References