Every loan you take on has a secret life, a hidden timeline that determines your financial path from debt to freedom.

This journey is guided by amortization, a process that might seem complex but holds the key to saving money and building wealth.

By unraveling its mysteries, you can take control of your financial destiny and make every payment count toward a brighter future.

Amortization is more than just a banking term; it's the systematic method used to pay off loans through regular, equal installments.

Each payment covers both interest and principal, ensuring that over time, you chip away at the debt until it's fully repaid.

This structure is common in mortgages, auto loans, and personal loans, providing a predictable schedule for borrowers.

At the heart of amortization lies the amortization schedule, a detailed table that breaks down every payment into its components.

This schedule reveals how your money is allocated, showing the shifting balance between interest and principal over the loan's term.

It's a powerful tool that can help you plan for tax deductions, as interest payments are often deductible.

Understanding this schedule allows you to see the true cost of borrowing and identify opportunities for savings.

Key elements of an amortization schedule include:

The formula for calculating the fixed monthly payment is essential for creating these schedules.

It uses the principal amount, monthly interest rate, and total number of payments to ensure consistency.

This iterative process means that with each payment, the interest portion decreases while the principal portion increases.

Not all amortization is created equal; different structures can impact your payments and total interest.

Knowing these options helps you choose the right loan for your needs and budget.

The main types include:

Each structure has its advantages, depending on whether you prioritize lower initial payments or faster equity growth.

For most borrowers, the standard equal payment method is common, but exploring alternatives can reveal better fits.

Let's bring this to life with concrete numbers that show how amortization works in practice.

Consider a $30,000 loan at 5% annual interest over 5 years with annual payments.

The table below illustrates the amortization schedule, highlighting the shift from interest to principal.

Notice how the interest portion shrinks each year, while the principal repayment grows.

This dynamic is why early payments feel like they're mostly going to interest, but over time, you build equity faster.

For a longer-term loan, such as 10 years, the payments are lower, but total interest paid increases significantly.

This example underscores the importance of considering loan term when making borrowing decisions.

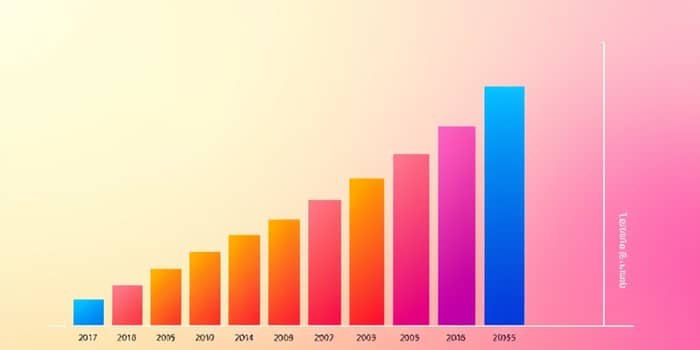

Graphs and charts can make amortization more tangible, showing the gradual decline in interest and rise in principal.

Line graphs often depict this with descending orange lines for interest and ascending blue lines for principal.

Pie charts can illustrate how the proportion of interest to principal changes over the loan's lifespan.

Early on, interest might dominate 70-90% of your payment, but by the end, it drops to 10-20%.

Using tools like Excel or online calculators, you can generate these visuals to better understand your loan.

Benefits of visualizing amortization include:

Amortization isn't just about understanding; it's about leveraging that knowledge to save money and achieve goals faster.

The front-loaded interest structure means that making extra payments early can have a massive impact.

By reducing the principal sooner, you lower the total interest paid and accelerate your path to debt freedom.

Tools and resources available to help include:

Key strategies to implement today:

Remember, every dollar you save on interest is a dollar you can invest in your future.

Understanding amortization transforms it from a hidden process into a powerful ally in your financial journey.

It reveals the secret lifespan of your loan, showing how each payment contributes to your ultimate freedom.

By embracing this knowledge, you can make informed decisions that align with your goals and values.

Start by accessing your loan's amortization schedule today and exploring ways to optimize it.

Whether you're paying off a mortgage, car loan, or student debt, this insight can lead to significant savings.

Let amortization be the tool that unlocks your potential for a debt-free and prosperous life.

References